Critical Mass Vancouver, July 2023

Milan Ilnyckyj at July 2023 Critical Mass in Vancouver, by @jordanvegbike

By happenstance or grace I ran into the best Vancouver Critical Mass in years when the library ushered me out at 6pm. It was my first bike ride in 11 years, and my first e-bike ride ever, on a rental e-bike available right beside the mustering area north of the old art gallery.

Critical Mass is one of the most brilliant forms of non-violent direct action ever devised. Today’s Vancouver ride showed me the city like I never saw it in 22 years growing up, and felt like the safest bike ride I ever took. Safe in the middle, I never worried about a single car. There were pairs of kids on the back of long e-bikes; dogs in carriers wearing goggles; several audio mixes from portable speakers in different parts of the mass; and a lot of good grace and patience — as well as a great deal of overt support — from pedestrians as well as drivers.

Vancouver

We have arrived safe in North Vancouver via Kamloops, Lillooet, and Whistler — managing to avoid any major fire delays more by luck and Sasha’s dedication behind the wheel than by foresight and planning. He did all our driving in three back to back days, and did today’s stretch through the heaviest traffic, steepest and twistiest roads, and our only night driving of the voyage.

We worked in a few short pauses to enjoy the views from the mountains. I hadn’t realized how beautiful the area around Lillooet is, with a semi-arid landscape, rocky peaks overhead, and vertiginous drops into the river canyon. It would be a fine place to return in no hurry and with a tripod and landscape photography gear. A hot tip from a German man at a roadside viewpoint took us on a ten minute hike to a stunning panoramic view at 50.65983, -121.98589.

A stop in Pemberton yielded kimchi and pulled pork sandwiches and smashed fries, which seemed just right as our last rest and meal of the journey.

After a night in tents and three solid days of driving, the last stretch in the dark through Whistler and Squamish had Sasha showing his only noticeable fatigue of the journey, which we countered with lively songs and an effort I made to dance in my seat to kinetically counteract the idea of tiredness.

Our parents welcomed us late in the evening with great hospitality and kindness. Because of the fires and the importance of Sasha not driving when too tired, I had been planning based on a five day drive with two extra days for delays and detours. As a result, I am in Vancouver with five days before the next phase of this visit is to begin. To pack light, I omitted to bring any camera gear, so my hope of digitizing the family albums on this visit is set aside.

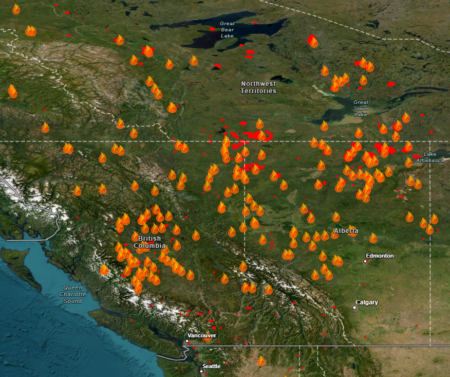

While the time together was joyful and rewarding, we did spend the day very concerned about the fire threatening Bechoko. I watched the news and fire map updates while Sasha kept up with friends over messages and social media. The danger there is great and everyone has been directed to evacuate, and the structures and environs of the community are in peril. All we can do now is hope that the three homes that have already been lost will be all that are taken, and then regardless of the actual damage realized during this fire season do what we can to support the people impacted. I wish this unprecedented fire season was having a decisive political effect, pushing the public and politicians to accept that it is madness and a profound and irreversible betrayal of the young to keep producing and expanding fossil fuels. It isn’t really prosperity when you get or stay rich by burning up the prospects of those who will come after you, but our cognitive blockages to accepting and taking responsibility for the consequences of our actions continue to paralyze us into accepting a world-wrecking status quo. I don’t know what can break that complacency, but the way in which we carry on heedlessly incinerating the future with our coal, oil, and gas dependence is setting us up to be justly remembered as the generations that squandered the common heritage of humankind for the sake of our own ease and enjoyment.

Valemount addendum

The hours of predicted rain ended up being a few drops while we were camping — and we were lucky enough to decamp in dry conditions. Now we are heading southwest to try and make our way through Kamloops despite the fire. If we can, we may pause in Manning Park for a hike. It’s 680 km from Valemount to my parents’ house, if we can take the most direct route with no detours, so there is a good chance we will sleep there tonight.

Valemount

Sasha and I had a fine second day of travel. We woke in our comfortable room in Grimshaw and proceeded to Hinton, where there is a disc golf course which Sasha had praised. It was indeed excellent: ringed with majestic mountain peaks and wooded so as to add to both the beauty and the challenge. My only prior experience was a very informal round on the Toronto Island with my father and some cousins several years ago, so I largely stuck to the low-risk “hammer” technique of throwing the disc sideways from over my head, reducing the chances of an early or late release sending me way out into the woods, though I did have some 9–13 throw efforts on holes with par of 3 or 4 and I did a fair bit of searching for discs that landed out of sight in the undergrowth or which were taken in surprising directions by the sometimes-strong and gusty wind. One of those undergrowth searches brought me within five feet of a startled red fox, which bounded off immediately as I carried on the search for my ‘driver’ disc. The whole effort was a lot of fun, and Sasha introduced me to an Indigenous ritual of paying the land with tobacco and thanks partway through.

After that pleasant and contrasting athletic detour, we carried on into the towering Rockies and Jasper where, after I was put off by bistros with $30–60 dishes, we got salad and sandwich ingredients and found a scenic spot by a lake on our road forward for a satisfying picnic. En route we listened to the end of The Hobbit, and I felt the wisdom of Thorin’s dying words about how a world where food and cheer are valued above hoarded gold when Sasha lent me a fleece against the mountain cold and we enjoyed a delicious meal in an unbeatable setting.

From there we continued to our day’s objective of Valemount. Every hotel and motel was $250–300 and fully booked to boot, so we called around and found a campsite for what is predicted to be a rainy night and morning. Nevertheless, I felt glad at least before going to sleep about including a night of camping in our voyage home, in part because I brought a tent mailed to Toronto for him by my mother and because I had packed super-light for the trip in everything aside from my PhD grad gift tent, sleeping pad, sleeping bag, and collapsable pillow.

As I bed down for as early a sleep as I can manage, I am grateful for this concentrated time together with Sasha, for all the songs we sang along to along the road today, and for the quality of his company and conversation. I was likewise grateful to catch up on some of the events and people from our years apart. It was heartening to hear how many friends he has made in the community where he taught for the past two years, and what a good impression he has made on people there.

During one of the spans where I had cell phone service (I do not have it in the campground) I sent a selfie of us both with soaring mountains behind to friends and family.

There is a terrible fire near Kamloops, which is part of both efficient tracks home from here, so there may yet be delays and detours. With luck we will drive to Manning Park and have a hike there before proceeding to Vancouver. We budgeted a week for what could have ideally been a 3–4 day trip, so we may have some time together in Vancouver or a hike there too, or perhaps I will be able to go all the way to Victoria with him before returning to Vancouver at the end of the month for the second part of this west coast visit — my first since the Christmas Greyhound journey in 2009. Over the course of the drive we crossed the Mackenzie, Athabasca, and Fraser rivers, a who’s who of major watercourses in western Canada.

Yellowknife to Vancouver drive, day 1

Sasha and I woke early at our B&B in Yellowknife and after a simple breakfast began our drive south. Tragically, we were never invited to meet the proprietors’ 24-year-old parrot Cosmo (possibly “Gosmo”) McBeaky, which I heard when booking from Toronto and had been psyched to meet north of 60°.

In Yellowknife and during the NWT and northernmost Alberta parts of the trip, the air quality was at 11 in the Apple weather app, whereas I never saw worse than 7 in Toronto. We drove past Sasha and Mica’s former school in Edzo, and then down toward the route through High Level which we had chosen to avoid wildfires near the Liard highway.

For most of the drive, we swapped between our respective Spotify libraries (mine only in the minority of spots with cell coverage, because there is no space on my phone for downloads) and sang along to the many songs we both know. We also listened to Serkis’ reading of The Hobbit from the battle against Smaug in Esgaroth to the very cusp of the eucatastrophe in the Battle of Five armies before pausing in High Table to share a large Mediterranean pizza.

We added another 300 km to our earlier 700 and got to Grimshaw as a severe thunderstorm was starting. We opted not to camp due to the expected bad weather and checked into the last available room in a hotel full of fire-fighting teams and lost power ten minutes later when Sasha was in the pool and I was doing an intense 25 minutes on the elliptical machine (my first time since the U of T gyms closed for COVID). I feel like I’m fitter than I remember being then, but part of it was surely desire to move my legs after a bus and three flights followed by the three hour Oppenheimer screening we attended last night, plus today’s driving.

I saw more ravens in a day than I think I ever have, and we got a close look at twenty or so bison of all sizes standing around and atop the road. They have truly impressive bulk and presence, and seemed utterly unperturbed by us, though willing to slowly shift off the road while we watched them and took some photos.

We are monitoring wildfire locations and road closures, but presently planning to drive into BC via Jasper and to camp tomorrow night if we can find a good spot and decent weather. To leave space in the Mazda for Sasha’s move I packed as light as possible, omitting a fly for my tent and all my rainy weather clothes (indeed, I brought just three shirts, my two intact-ish pairs of cargo trousers, and fresh daily socks for a five day trip).

I am hugely grateful to my parents and especially my mother for making the trip possible by helping me secure an apartment as guarantors. The chance to spend one-on-one time with Sasha is a true blessing, and the trip will doubtless be a source of memories and stories between us for life.

New Ottawa bike bridge forthcoming

On my first day of work for Environment Canada in August 2007, I was staying in the basement of a family friend in Orleans. I had never taken the transit route to the Terrasses de la Chaudière (TLC) complex and it was already hot in the early morning, doubly so in a suit and tie.

Since I was on an express bus, I falsely assumed that it would stop at every stop, like a subway train, even if nobody pressed the stop request. As such, I found myself zooming past the LeBreton Flats stop where I was meant to change buses.

I didn’t yet have a smartphone, and I didn’t know the route for the bus — so I didn’t know if waiting on the opposite side of the street would yield a bus going back to the stop I missed. Since I was still very early for work and the bus had only driven a few minutes between stops, I got off and began walking back east along the transitway.

Soon I was stopped by a police squadcar, who, despite my explanation of having my first day of work starting and not knowing the bus routes, insisted that I could not walk along the edge of the dedicated bus road. Oddly, they told me I should walk through an area of empty scrubland to a railway bridge, and walk across that into Quebec.

It seemed an odd choice for the police. Either they were trying to uphold the law or protect my safety, but neither objective was clearly served by this plan. Nonetheless, it would be years yet before the city fenced off the out-of-service Price of Wales bridge, so I was able to walk across without trouble, reach work early, and meet my first colleague.

I told her the story of my walk hoping it would be a small humanizing connection between the two of us, but she rapidly shared the story with the whole office.

I was reminded of the whole incident while waiting by my departure gate at Pearson airport this morning, because I ran across a news story about how the bridge is being converted into dedicated cycle infrastructure. That seems like a great choice. The nearby Chaudiere bridge is rather harrowing, with cars racing down the narrow lanes quite close to exposed pedestrians. The nearest nice cycle crossing is essentially at the far side of Gatineau, at the Alexandra Bridge. Hopefully, once the new bike bridge opens I will get the chance to try it on two wheels on a future Ottawa visit. The bridge is in a great location to connect the excellent riverside bike path to, first, the densest concentration of federal government buildings in Quebec and, second, the enormous Gatineau Park which begins as a thin wedge nearby.

Live advisories on road closures in BC, Alberta, and the Northwest Territories

Libraries as sanctuaries

At least since elementary school, I have loved the combination of charms offered by libraries, perhaps chief among them the provision of a serene space for concentration and thought with the freedom indiscriminately granted to take an interest in anything from the collection. I remember at my elementary school library, at Cleveland Elementary School, there were wooden-drawered filing cabinets for index cards. I remember the age-yellowed peculiar tinge and feeling of the index cards, perhaps made by hand on a typewriter, and the feeling of avenues into knowledge being revealed through the process of beginning with any topic of interest and working from books to index to books to begin tracing paths on rivers of thought and language that exist to help us each understand the world.

The first massive library which I was free to explore was the colosseum-inspired Central Branch of the Vancouver Public Library, which was approved by referendum in 1990 and opened for public use in 1995. My friend Chevar and I were excused by our parents from school to attend the grand opening, which included a massive chocolate cake in the shape of the building’s unique form. For visitors to Vancouver, I strongly recommend going up to the appropriate floors to try the sky bridges and outer seating areas available on the far side of the central atrium. It’s a place where I read happily until I stopped being a Vancouver resident, and I can still remember the way the brand-new-library smell evolved into a stable characteristic odor with a hint of escalator oil and rubber as base notes.